do pastors pay taxes on book sales

Megachurch pastors are especially vulnerable to tax audits. 417 Earnings for Clergy.

Forgive By Timothy Keller Westminster Bookstore

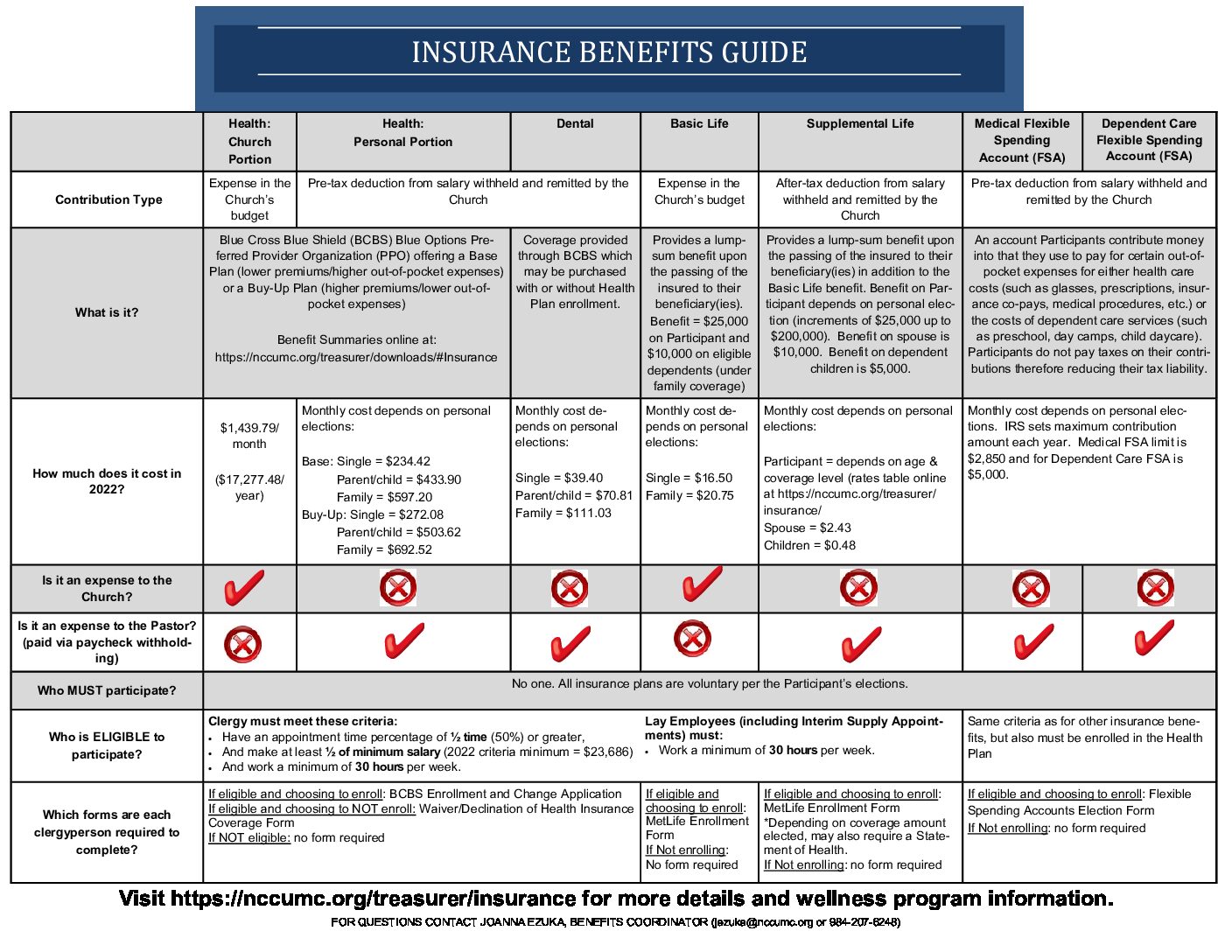

Another mistake regarding sales tax relates to the pastors parsonage.

. If a love offering is made to compensate a pastor for services previously performed then it is taxable. Web Pastors in the United States pay taxes on income. With the 2018 tax changes the standard deduction is up by between 150 and 300 depending on filing status.

Web The IRS could also impose penalties on your pastor and church leaders. Web While it is true that churches merely by the virtue of truly being churches enjoy tax-exempt status from federal corporate taxes that does not mean that churches do not pay taxes. As a result the church should pay sales tax on prize purchases.

If you make 1000 youre. Joel is a resident of Texas one of nine states in the USA that has no income tax. Yes pastors pay federal.

Web Do pastors pay taxes on love offerings. Churches may be tax exempt but pastoral salary certainly is considered taxable income. Below is the difference.

Web Tax Exempt and Government Entities EXEMPT ORGANIZATIONS Tax Guide for Churches Religious Organizations 501c3 Publication 1828 Rev. Answered as a US tax specialist and the spouse of a man who worked exclusively as a Presbyterian pastor for 13 years. Web First of all the answer is no churches do not pay taxes.

Web To ensure the proper amount of tax is withheld the clergy person should divide his total compensation parsonage plus non-parsonage by the number of pay periods and. Web Topic No. In many states the.

As a result the church should pay sales tax on prize purchases. This means congregation members may be less tempted. Web Answer 1 of 3.

The church should issue him a W-2 and then it is his business whether he files is taxes or not. Web Answer 1 of 15. A licensed commissioned or ordained minister is generally the common law employee of the church denomination sect or.

Web Does Joel Osteen Pay Taxes Legally He Can Utilize These Breaks As a result the church should pay sales tax on prize purchases.

Does Joel Osteen Pay Taxes Legally He Can Utilize These Breaks

Does Joel Osteen Pay Taxes Legally He Can Utilize These Breaks

Understanding Tax Exempt Status Must Churches Follow All Irs Rules If They Do Not Apply For Tax Exempt Status Provident Lawyers

2021 Church Clergy Tax Guide Richard R Hammar 9781614072423 Amazon Com Books

Amazon Com Worth S Income Tax Guide For Ministers 2017 Edition For Preparing 2016 Tax Returns 9780991219261 Worth Beverly J Books

The Pastor S Guide To Taxes And The Irs Ascension Cpa

Five Things You Should Know About Pastors Salaries Church Answers

Pastor And People R T Williams 1939 Hardcover Book Church Nazarene Christian Ebay

The Evangelicals The Struggle To Shape America Kindle Edition By Fitzgerald Frances Politics Social Sciences Kindle Ebooks Amazon Com

The Dorean Principle A Biblical Response To The Commercialization Of Christianity

Joel Osteen Probably Does Pay Taxes Despite Twitter Rumors

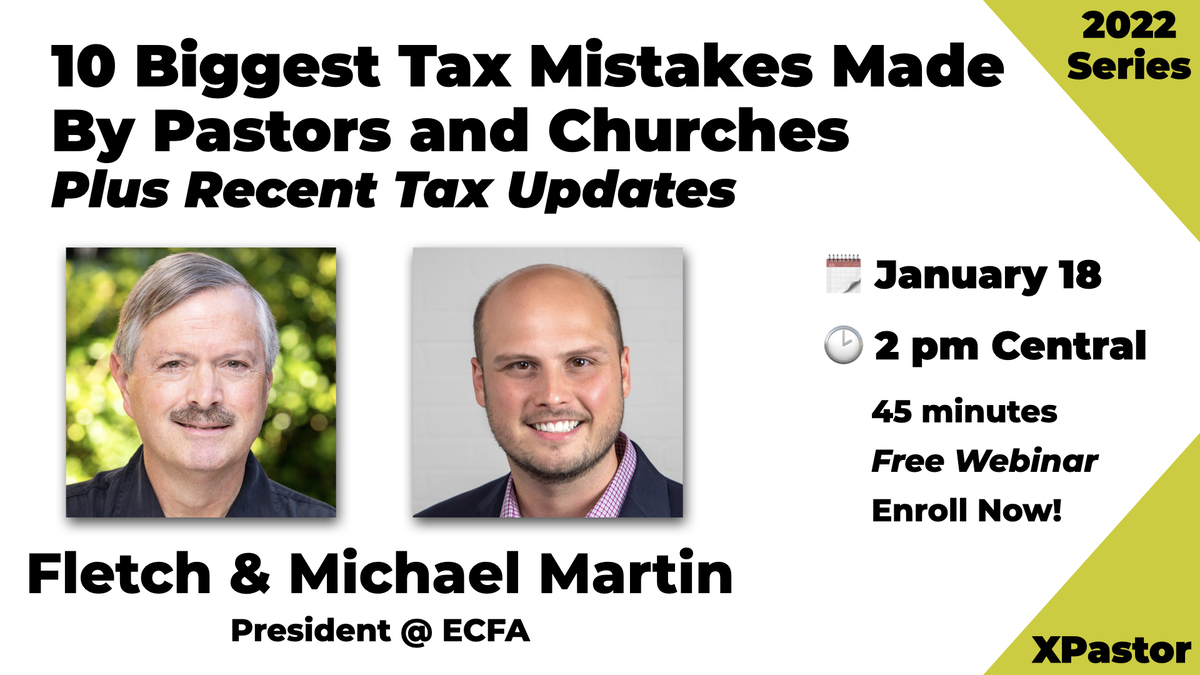

Caesar Takes A Pastor S Salary Xpastor

Conversion How God Creates A People 9marks Building Healthy Churches Lawrence Michael 9781433556494 Westminster Bookstore